收入达 1.05 亿美元,季度末总收入达 1.13 亿美元,创历史新高

运营现金流达 2500 万美元

(2024 年 8 月 7 日,明尼苏达州明尼阿波利斯)--全球领先的业务和关键任务物联网(IoT")产品、服务和解决方案提供商 Digi International® 公司(纳斯达克股票代码:DGII)今天公布了截至 2024 年 6 月 30 日的第三财季财务业绩。

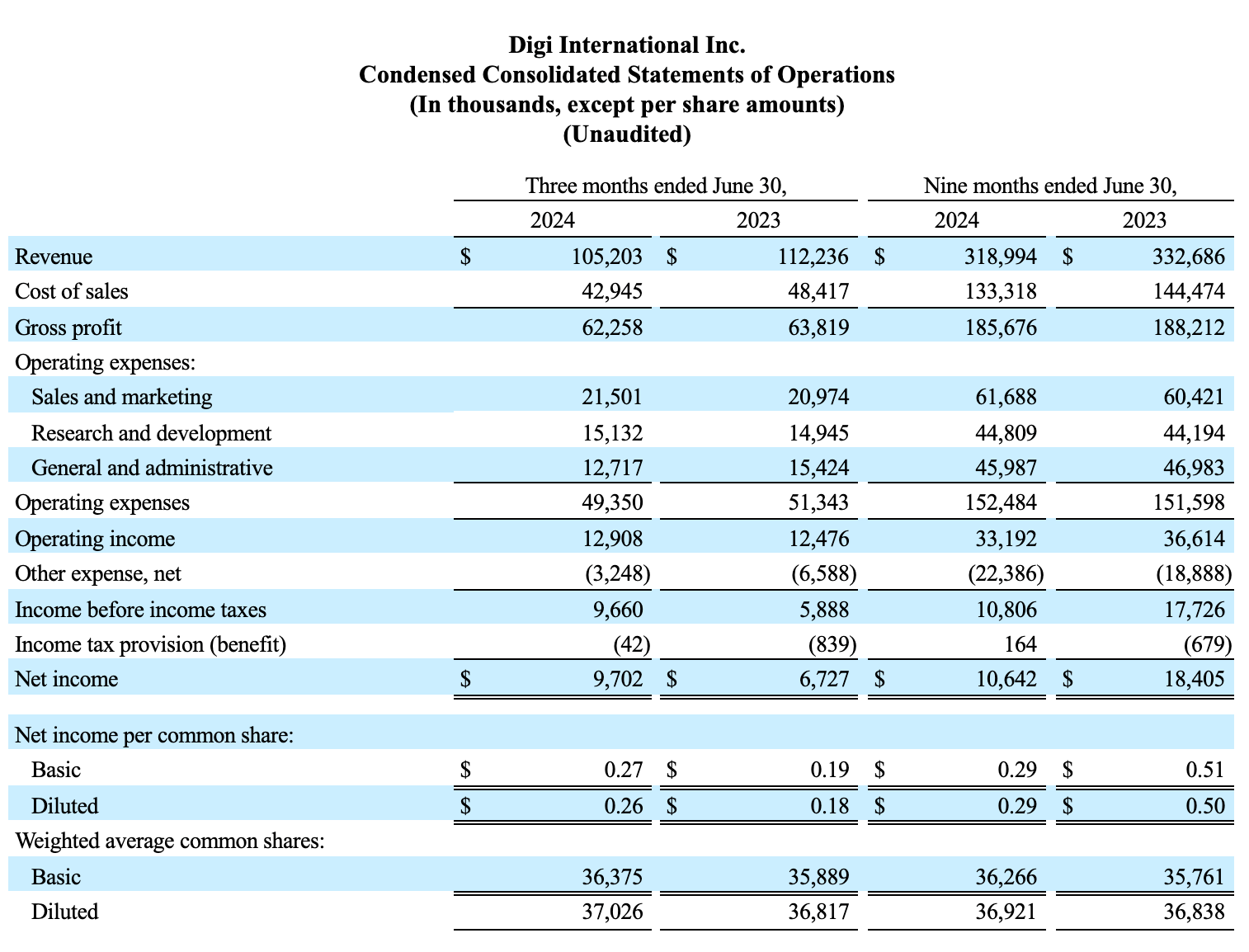

2024 财年第三季度业绩与 2023 财年第三季度业绩的比较

- 收入为 1.05 亿美元,减少了 6%。

- 毛利率为 59.2%,增加了 230 个基点。

- 净收入为 1000 万美元,而去年同期为 700 万美元。

- 摊薄后每股净收益为 0.26 美元,而去年同期为 0.18 美元。

- 调整后摊薄后每股净收益为 0.50 美元,同比持平。

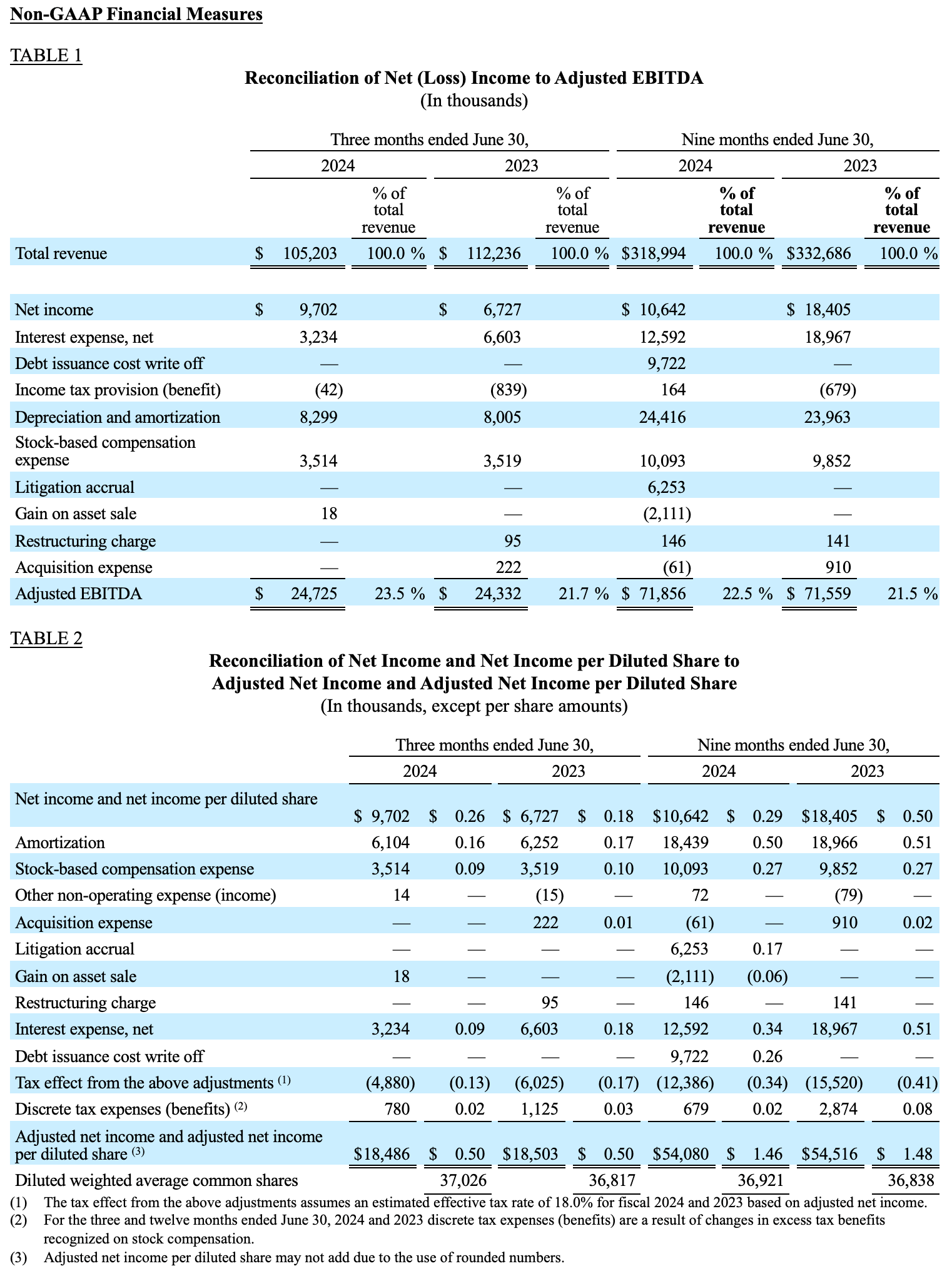

- 调整后息税折旧摊销前利润(EBITDA)为 2500 万美元,增长了 2%。

- 截至本季度末,年化经常性收入(ARR)为 1.13 亿美元,增长了 9%。

本新闻稿末尾载有 GAAP 和非 GAAP 财务指标的调节表。

"Digi继续执行其首要任务,提供有价值的IoT 解决方案。这一工作重点使 ARR 达到创纪录的 1.13 亿美元,毛利率也创下新高。强有力的运营纪律帮助实现了创纪录的 A-EBITDA 利润率和强劲的现金生成,"公司总裁兼首席执行官 Ron Konezny 说。"在网络安全和数据保护成为重中之重的日益严峻的市场环境中,Digi 已经做好了充分准备。我们的团队正在不断加强,将专业服务与我们的解决方案相结合,为我们的渠道和最终用户提供令人信服的选择。

其他财务要点

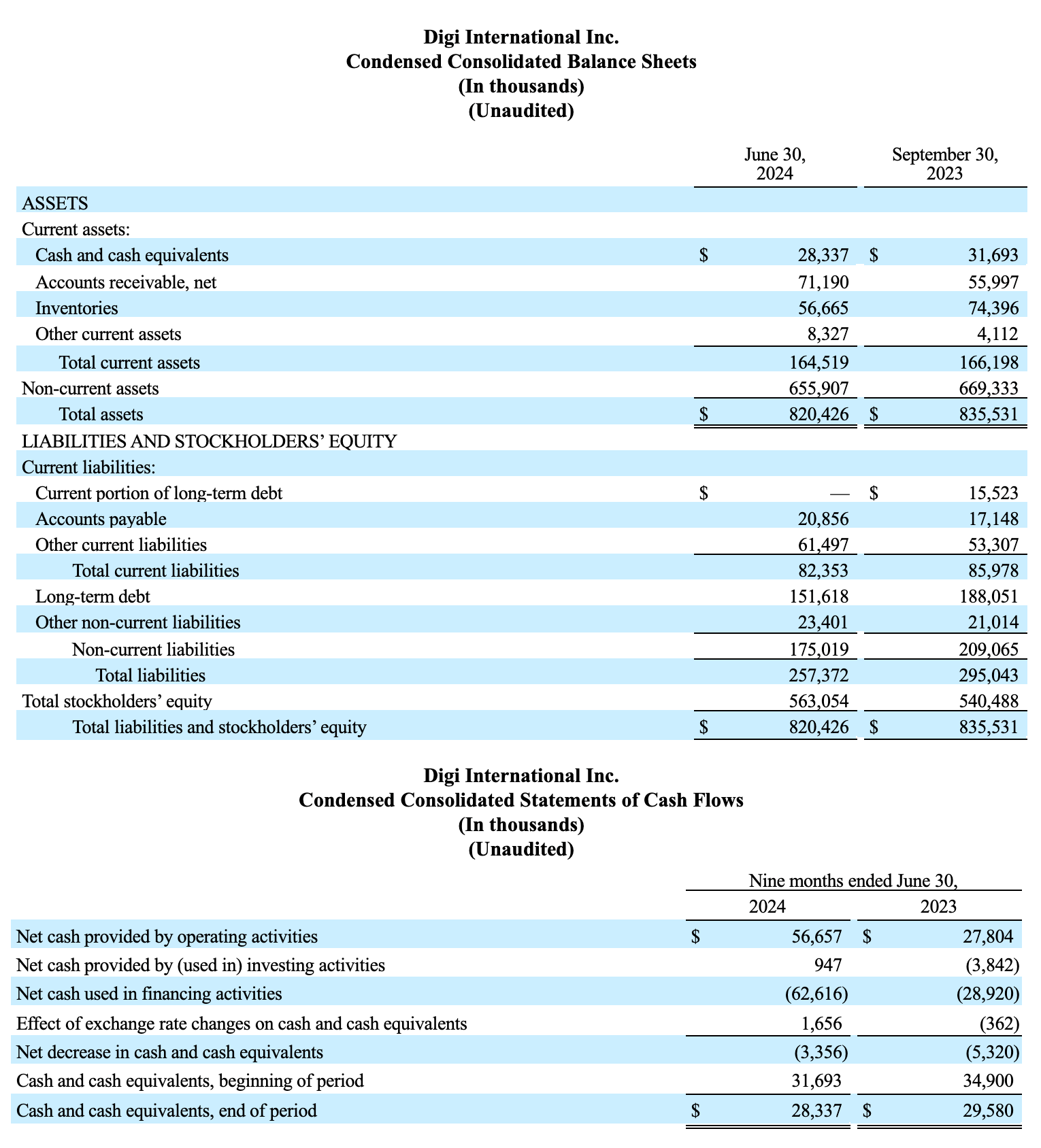

- 我们利用循环信贷机制支付了款项,使我们的未偿债务净额在季度末降至 1.52 亿美元,扣除现金和现金等价物后的债务净额降至 1.23 亿美元。

- 2024 财年第三季度,我们的利息支出为 320 万美元,去年同期为 660 万美元。利息支出减少的原因是未偿债务减少和实际利率降低。

- 2024 财年第三季度的运营现金流为 2500 万美元,去年同期为 1800 万美元,这主要得益于库存的同比变化。

- 本季度末的净库存为 5700 万美元,而 2023 年 9 月 30 日的净库存为 7400 万美元,这反映了管理库存水平的持续努力。

分部业绩

IoT 产品与服务

该部门 2024 财年第三季度的收入为 8000 万美元,与上一财年同期相比减少了 740 万美元。减少的原因是一次性销售额减少了 790 万美元,定价没有产生重大影响,但经常性收入增长 50 万美元部分抵消了减少额。截至第三财季末,ARR 为 2300 万美元,比上一财年增长了 5%。这一增长主要得益于延保产品和远程管理平台订购量的增长。2024 财年第三季度的毛利率增长了 30 个基点,达到收入的 54.4%,这主要得益于库存调整的减少和通胀压力的降低。

IoT 解决方案

该部门 2024 财年第三季度的收入为 2500 万美元,与上一财年同期相比增加了 30 万美元,其中经常性收入增加了 170 万美元,但被硬件销售额减少的 80 万美元和一次性服务量减少的 60 万美元部分抵消。截至第三财季末,ARR 为 9000 万美元,在 SmartSense 增长的推动下,比上一财年增长了 10%。2024 财年第三季度的毛利润率增长了 770 个基点,达到 74.4%。这一增长得益于利润率较高的 ARR 订阅收入的增长。

资本分配战略

随着供应链的不断正常化,我们打算去杠杆化,同时寻求最佳库存水平,库存余额的下降就证明了这一点。

收购仍然是 Digi 的首要资本优先事项。我们将采取严谨的态度,在我们认为机会合适的情况下,根据当前的市场条件采取行动。我们正在发展和监控我们的收购渠道,我们打算更加注重规模和平均收入。

2024 财年第四季度指导计划

Digi 仍将坚定不移地实现我们新的长期战略目标,即在未来五年内将资产收益率和调整后息税折旧摊销前利润翻一番,达到 2 亿美元。Digi 在规模庞大且不断增长的工业物联网市场中始终保持着顽强的执行力。我们对 2024 财年 ARR 增长率的展望提高到了 5%以上。尽管我们对年初至今的业绩感到满意,但我们发现客户对需求仍持谨慎态度。2024 财年,我们的调整后 EBITDA 预计将增长约 1%,收入预计将同比下降约 5%。这与之前提供的财政指导一致。宏观经济状况使我们无法确定销售周期何时以及在多大程度上会恢复到更正常的状态。

第四财季的收入预计为 1.02 亿至 1.06 亿美元。调整后息税折旧摊销前利润(EBITDA)预计在 2450 万美元到 2600 万美元之间。假设加权平均摊薄股数为 3,750 万股,预计调整后摊薄后每股净收益为 0.48 美元至 0.52 美元。

我们以非美国通用会计准则(GAAP)为基础,为调整后每股净收益以及调整后息税折旧摊销前利润(EBITDA)目标提供指导或长期目标。我们没有将这些项目与其最相似的美国通用会计准则指标进行对账,因为很难在不付出不合理努力的情况下对众多项目进行预测,这些项目包括但不限于外汇折算、重组、利息和某些税务相关事件的影响。鉴于不确定性,任何这些项目都可能对美国通用会计准则的结果产生重大影响。

2024 年第三季度电话会议详情

正如 2024 年 7 月 12 日宣布的那样,Digi 将于 2024 年 8 月 7 日星期三东部时间下午 5:00(中部时间下午 4:00)左右召开电话会议,讨论第三财季业绩。电话会议将由总裁兼首席执行官 Ron Konezny 和首席财务官 Jamie Loch 主持。

与会者可登录https://register.vevent.com/register/BIcc5261bce63c42b398b24fd89b29a861 注册参加电话会议。注册完成后,与会者将获得一个拨入号码和密码,以便接入电话会议。请所有与会者在会议开始前 15 分钟拨号。

与会者可以通过 Digi 网站的投资者关系栏目https://digi.gcs-web.com/或托管网站https://edge.media-server.com/mmc/p/grsuwsnf/ 观看电话会议的网络直播。

重播将在电话会议结束后约两小时内提供,为期约一年。您可以通过 Digi 网站的 "投资者关系 "版块访问网络广播重播。

您可以通过 Digi 网站 www.digi.com 的 "投资者关系 "部分的 "财务新闻稿 "页面查阅本财报。

有关我们的更多新闻和信息,请访问www.digi.com/aboutus/investorrelations。

关于 Digi International

Digi International(纳斯达克股票代码:DGII)是全球领先的IoT 连接产品、服务和解决方案提供商。我们帮助客户创造下一代连接产品,在高要求环境中部署和管理关键通信基础设施,并提供高水平的安全性和可靠性。公司成立于 1985 年,目前已帮助客户连接了 1 亿多个设备,并且还在不断增长。欲了解更多信息,请访问 Digi 网站 www.digi.com。

前瞻性陈述

本新闻稿包含基于管理层当前预期和假设的前瞻性陈述。这些声明通常可以通过使用前瞻性术语来识别,如 "假设"、"相信"、"继续"、"估计"、"期望"、"打算"、"可能"、"计划"、"潜在"、"项目"、"应该 "或 "将要 "或其反义词或其他变体或类似术语。除其他事项外,这些声明涉及对 Digi 所处商业环境的预期、对未来业绩的预测、库存水平、预期的市场机会、利息支出节省以及有关我们的使命和愿景的声明。这些声明并不是对未来业绩的保证,其中包含一定的风险、不确定性和假设。其中包括与全球持续和不同的通货膨胀和通货紧缩压力、全球各国政府的货币政策有关的风险,以及目前和持续存在的对潜在经济衰退的担忧、像我们这样的公司在这种情况下经营全球业务的能力、在这种情况下对产品需求的负面影响以及客户和供应商的财务偿付能力、与持续影响全球业务的供应链挑战有关的风险、与网络安全有关的风险、当前乌克兰和中东战争引发的风险、我们公司所处的高度竞争市场、可能取代我们所销售产品的技术的快速变化、网络产品价格的下降、我们对分销商和其他第三方销售我们产品的依赖、重大采购订单被取消或变更的可能性、产品开发工作的延误、用户对我们产品接受程度的不确定性、以商业上可接受的方式将我们的产品和服务与其他方的产品和服务进行整合的能力、如果我们的任何产品存在设计或制造缺陷可能产生的潜在责任、我们整合和实现收购预期收益的能力、我们辩护或圆满解决任何诉讼的能力、自然灾害和其他超出我们控制范围的事件的影响,这些事件可能会对我们的供应链和客户造成负面影响;与结构调整、重组或其他类似业务举措相关的潜在意外后果,这些后果可能会影响我们留住重要员工的能力,或以其他意外和不利的方式影响我们的运营;以及我们的收入水平或盈利能力的变化,这些变化可能会因许多超出我们控制范围的原因而波动。这些及其他风险、不确定性和假设不时出现在我们向美国证券交易委员会提交的文件中,包括但不限于我们截至 2023 年 9 月 30 日的 10-K 表年报第 1A 项 "风险因素"、10-Q 表后续文件及其他文件中,可能导致我们的实际结果与我们或代表我们做出的任何前瞻性声明中表述的结果大相径庭。其中许多因素超出了我们的控制或预测能力。这些前瞻性表述仅适用于表述当日。我们否认有任何意图或义务更新任何前瞻性声明,无论是由于新信息、未来事件或其他原因。

非美国通用会计准则财务指标的列报

本新闻稿包括调整后净收入、调整后摊薄后每股净收入和调整后息税折旧摊销前利润(EBITDA),其中每项均为非美国通用会计准则(Non-GAAP)指标。

我们知道,非美国通用会计准则的使用存在重大限制。在分析财务业绩时,非美国通用会计准则(Non-GAAP)指标不能替代净收入等美国通用会计准则(GAAP)指标。这些指标的披露并不反映 Digi 实际确认的所有费用和收益。这些非美国通用会计准则(Non-GAAP)衡量标准不符合公认会计原则,也不能替代按照公认会计原则编制的衡量标准,可能与其他公司使用的非美国通用会计准则(Non-GAAP)衡量标准或我们在以前的报告中提出的衡量标准不同。此外,这些非美国通用会计准则衡量标准并非基于任何一套全面的会计规则或原则。我们认为,非美国通用会计准则衡量标准有其局限性,因为它们不能反映按照美国通用会计准则确定的与我们的运营结果相关的所有金额。我们认为,这些指标只能与相应的公认会计准则指标一起用于评估我们的运营结果。此外,调整后 EBITDA 并不反映我们的现金支出、更换折旧资产和摊销资产的现金需求,也不反映我们营运资金需求的变化或现金需求。

我们认为,分别提供历史净利润和调整后净利润以及调整后摊薄后每股净利润,不包括税收准备金转回、离散税收优惠、重组费用及转回、无形资产摊销、股票薪酬、其他营业外收入/支出、或有对价公允价值变动、与收购相关的费用以及与收购相关的利息支出等项目,可以让投资者将业绩与不包括这些项目的前期进行比较。管理层使用上述非美国通用会计准则衡量标准来监控和评估持续经营业绩和趋势,并了解我们的比较经营业绩。此外,我们的某些股东表示希望看到不包含这些事项影响的财务业绩指标,这些事项虽然重要,但对我们的核心业务运营并不重要。管理层认为,调整后息税折旧摊销前利润(定义为息税折旧摊销前利润,根据股票薪酬费用、收购相关费用、重组费用和转回以及或有对价公允价值变动进行调整)有助于投资者评估我们的核心经营业绩和财务表现,因为它排除了简明合并运营报表中反映的重大非现金或非经常性项目。我们认为,将调整后 EBITDA 按收入百分比列报是有用的,因为它提供了一种可靠、一致的方法来衡量我们每年的业绩,并将我们的业绩与其他公司的业绩进行比较。我们相信这一信息有助于比较经营业绩和公司业绩,其中不包括我们的资本结构和资产收购方法的影响。

投资者联系方式:

罗布-贝内特

投资者关系

迪吉国际

952-912-3524

电子邮件:rob.bennett@digi.com