季度收入创历史新高,达 1.12 亿美元,季度末净资产收益率达 1.04 亿美元

每股收益 0.18 美元,调整后每股收益 0.50 美元

(2023 年 8 月 3 日,明尼苏达州明尼阿波利斯)- 全球领先的业务和关键任务物联网(IoT")产品、服务和解决方案提供商 Digi International® 公司(纳斯达克股票代码:DGII)今天公布了截至 2023 年 6 月 30 日的第三财季财务业绩。

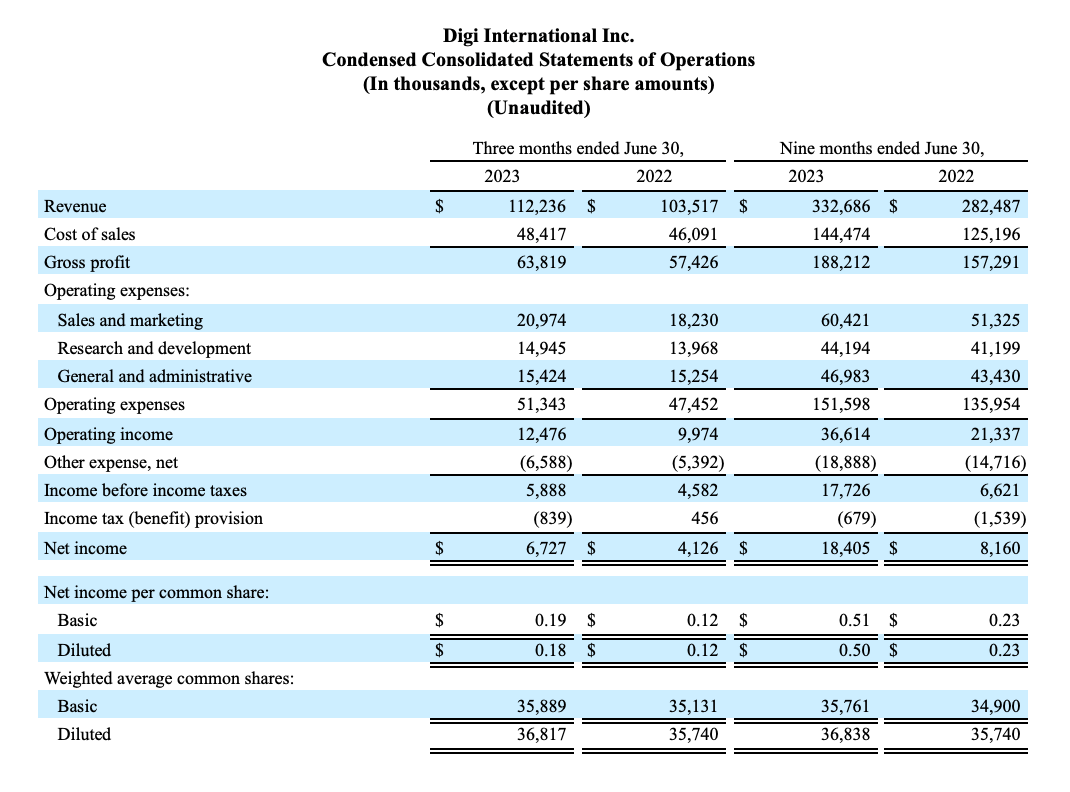

2023 财年第三季度业绩与 2022 财年第三季度业绩的比较

- 收入为 1.12 亿美元,增长了 8%。

- 毛利润率为 56.9%,增长了 140 个基点。 不包括摊销的毛利润率为 57.7%,增加了 100 个基点。

- 摊薄后每股净收益为 0.18 美元,高于 0.12 美元,增幅达 50%。

- 调整后的每股摊薄收益为 0.50 美元,增长了 11%。

- 调整后的息税折旧摊销前利润(EBITDA)为 2400 万美元,增长了 16%。

- 截至本季度末,年化经常性收入(ARR)为 1.04 亿美元,同比增长 13%。

本新闻稿末尾载有 GAAP 和非 GAAP 财务指标的调节表。

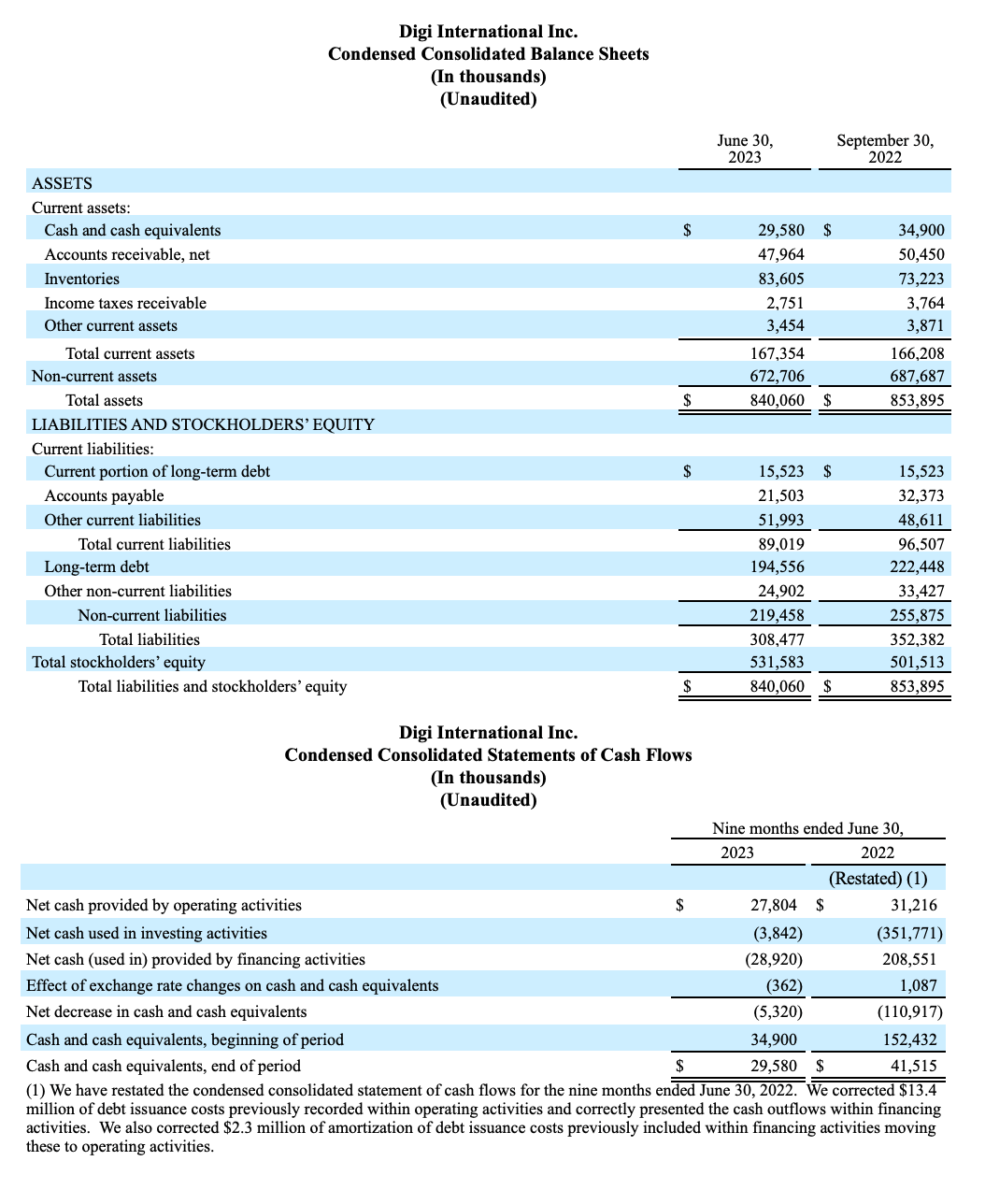

"Digi 连续第十个季度实现创纪录的收入,"公司总裁兼首席执行官 Ron Konezny 说。 "在年化经常性收入(ARR)强劲增长的推动下,我们实现了 "100 "目标中的第二个目标。 本季度末,年经常性收入超过了 1 亿美元。 此外,我们还将未偿债务本金减少了 2000 万美元。 我们团队的解决方案思维正在为客户和合作伙伴创造价值。

分部业绩

IoT 产品与服务

该部门 2023 财年第三季度的收入为 8700 万美元,比上一财年同期增长了 10%。 这一增长得益于 OEM 和基础设施管理产品线的增长。 截至第三财季末,ARR 为 2200 万美元,增长了 47%。 2023 财年第三财季的毛利率增长了 60 个基点,达到 54.1%。

IoT 解决方案

该部门 2023 财年第三季度的收入为 2500 万美元,比上一财年同期增长了 5%。 这一增长得益于 SmartSense 和 Ventus 产品销售额的增长。 截至第三财季末,ARR 超过 8200 万美元,增长了 6%。 由于 2023 财年第三财季的平均收入增加,毛利率增长了 450 个基点,达到 66.7%。

2023 财年第四季度指导计划

围绕即将到来的经济衰退以及衰退可能带来的严重后果的争论仍在继续。Digi 广泛的终端市场帮助公司度过了过去充满挑战的市场环境。我们认为,IIoT 市场仍处于早期应用阶段,存在大量的全新机遇。目前,世界上大多数机器尚未联网。随着时间的推移,我们预计会有更多的终端市场部署 IIoT。

2023 财年第四季度,我们预计收入为 1.08 亿至 1.12 亿美元,同比增长 2% 至 6%。调整后息税折旧摊销前利润(EBITDA)预计为 2300 万美元至 2400 万美元。假设加权平均股数为 3730 万股,调整后摊薄后每股收益预计为 0.46 美元至 0.49 美元。

根据我们第四财季的指导意见和年初至今的业绩,Digi 现在预计全年收入将至少增长 14%,高于我们上一季度公布的增长率。此前我们曾表示,预计在 2023 财年,ARR 和 A-EBITDA 的增长将超过总收入的增长。我们仍然预计 A-EBITDA 的增长速度将超过总收入的增长速度。我们仍然预计 ARR 的增长将与我们之前的预期一致,但可能不会超过总收入的增长。

我们按非美国通用会计准则(GAAP)提供盈利指导,因为很难合理确定地预测各种项目,包括但不限于外汇折算、利息和某些税务相关事件的影响。鉴于不确定性,任何这些项目或其他项目都可能对美国通用会计准则的结果产生重大影响。

2023 年第三季度电话会议详情

正如 2023 年 7 月 11 日所宣布的,Digi 将于 2023 年 8 月 3 日星期四东部时间上午 10:00(中部时间上午 9:00)召开电话会议,讨论第三财季业绩。 电话会议将由总裁兼首席执行官 Ron Konezny 和首席财务官 Jamie Loch 主持。

与会者可登录https://register.vevent.com/register/BI9b85c1468df24fcb826c07a7541ba76e 注册参加电话会议。注册完成后,与会者将获得一个拨入号码和密码,以便接入电话会议。请所有与会者在会议开始前 15 分钟拨号。

与会者可以通过 Digi 网站的投资者关系栏目https://digi.gcs-web.com/或托管网站https://edge.media-server.com/mmc/p/bt95nnhk 观看电话会议的网络直播。

重播将在电话会议结束后约两小时内提供,为期约一年。您可以通过 Digi 网站的 "投资者关系 "版块访问网络广播重播。

您可以通过 Digi 网站 www.digi.com 的 "投资者关系 "部分的 "财务新闻稿 "页面查阅本财报以及与第二财季业绩相关的股东信。

有关我们的更多新闻和信息,请访问 www.digi.com/aboutus/investorrelations。

关于 Digi International

Digi International(纳斯达克股票代码:DGII)是全球领先的IoT 连接产品、服务和解决方案提供商。 我们帮助客户创造下一代连接产品,在高要求环境中部署和管理关键通信基础设施,并提供高水平的安全性和可靠性。 公司成立于 1985 年,目前已帮助客户连接了 1 亿多个设备,并且还在不断增长。 欲了解更多信息,请访问 Digi 网站 www.digi.com。

前瞻性陈述

本新闻稿包含基于管理层当前预期和假设的前瞻性陈述。 这些声明通常可以通过使用前瞻性术语来识别,如 "假设"、"相信"、"预计"、"打算"、"估计"、"目标"、"可能"、"将"、"期望"、"计划"、"潜在"、"项目"、"应该 "或 "继续",或其反义词或其他变体或类似术语。 除其他事项外,这些声明涉及对 Digi 所处商业环境的预期、对未来业绩的预测、对市场机遇的认识以及有关我们使命和愿景的声明。 这些声明并不是对未来业绩的保证,其中包含一定的风险、不确定性和假设。 其中包括与影响全球业务的持续供应链和运输挑战有关的风险、与全球持续通胀压力和全球政府货币政策有关的风险、目前对潜在经济衰退的担忧、我们这样的公司在这种情况下经营全球业务的能力以及在这种情况下对产品需求和客户及供应商的财务偿付能力的负面影响、当前乌克兰战争带来的风险、公司所处市场的激烈竞争、可能取代我们所售产品的技术的快速变化、网络产品价格的下降、我们对分销商和其他第三方销售产品的依赖、大量采购订单被取消或变更的可能性、产品开发工作的延误、用户对我们产品接受程度的不确定性、以商业上可接受的方式将我们的产品和服务与其他方的产品和服务进行整合的能力、如果我们的任何产品存在设计或制造缺陷可能产生的潜在责任、我们整合和实现收购预期收益的能力、我们辩护或圆满解决任何诉讼的能力、自然灾害和其他超出我们控制范围的事件的影响,这些事件可能会对我们的供应链和客户造成负面影响;与结构调整、重组或其他类似业务举措相关的潜在意外后果,这些后果可能会影响我们留住重要员工的能力,或以其他意外和不利的方式影响我们的运营;以及我们的收入水平或盈利能力的变化,这些变化可能会因许多超出我们控制范围的原因而波动。 这些以及其他风险、不确定性和假设不时出现在我们向美国证券交易委员会提交的文件中,包括但不限于我们截至 2022 年 9 月 30 日的 10-K 表年报和随后的 10-Q 表报告,可能会导致我们的实际结果与我们或代表我们做出的任何前瞻性声明中表述的结果大相径庭。 其中许多因素超出了我们的控制或预测能力。 这些前瞻性表述仅适用于表述当日。 我们否认有任何意图或义务更新任何前瞻性声明,无论是由于新信息、未来事件或其他原因。

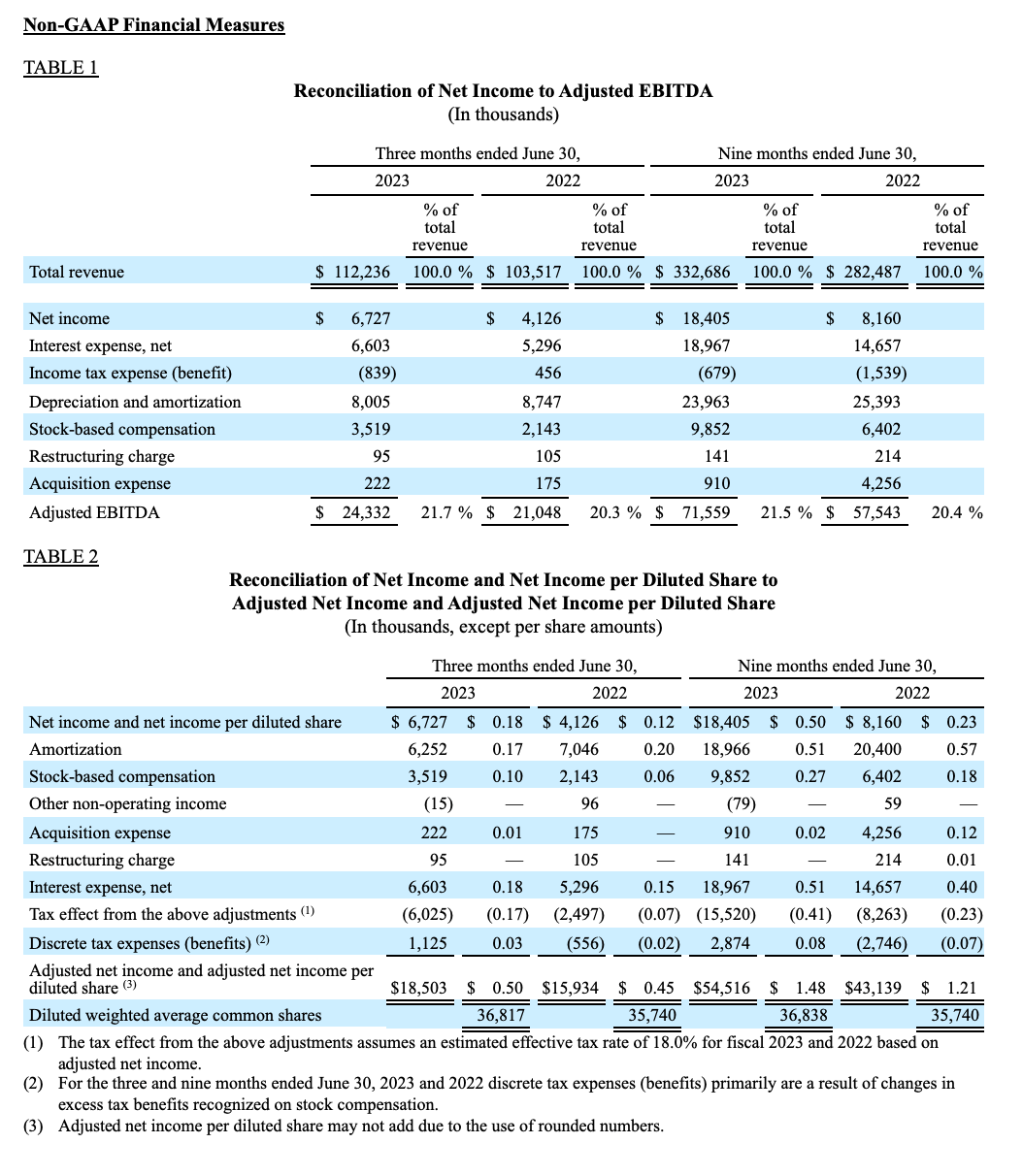

非美国通用会计准则财务指标的列报

本新闻稿包括调整后净收入、调整后摊薄后每股净收入和调整后息税折旧摊销前利润(EBITDA),其中每项均为非美国通用会计准则(Non-GAAP)指标。

我们知道,非美国通用会计准则的使用存在重大限制。 在分析财务业绩时,非美国通用会计准则(Non-GAAP)指标不能替代净收入等美国通用会计准则(GAAP)指标。 这些指标的披露并不反映 Digi 实际确认的所有费用和收益。 这些非美国通用会计准则(Non-GAAP)衡量标准不符合公认会计原则,也不能替代按照公认会计原则编制的衡量标准,而且可能不同于其他公司使用的非美国通用会计准则(Non-GAAP)衡量标准,也不同于我们在以前的报告中介绍的非美国通用会计准则(Non-GAAP)衡量标准。 此外,这些非美国通用会计准则衡量标准并非基于任何一套全面的会计规则或原则。 我们认为,非美国通用会计准则衡量标准有其局限性,因为它们不能反映按照美国通用会计准则确定的与我们的运营结果相关的所有金额。 我们认为,这些指标只能与相应的公认会计准则指标一起用于评估我们的运营结果。 此外,调整后 EBITDA 并不反映我们的现金支出、更换折旧资产和摊销资产的现金需求,也不反映我们营运资金需求的变化或现金需求。

我们认为,分别提供历史净利润和调整后净利润以及调整后摊薄后每股净利润,不包括税收准备金转回、离散税收优惠、重组费用及转回、无形资产摊销、股票薪酬、其他营业外收入/支出、或有对价公允价值变动、与收购相关的费用以及与收购相关的利息支出等项目,可以让投资者将业绩与不包括这些项目的前期进行比较。 管理层使用上述非美国通用会计准则衡量标准来监控和评估持续经营业绩和趋势,并了解我们的比较经营业绩。 此外,我们的某些股东表示希望看到不包含这些事项影响的财务业绩指标,这些事项虽然重要,但对我们的核心业务运营并不重要。 管理层认为,调整后息税折旧摊销前利润(定义为息税折旧摊销前利润,根据股票薪酬费用、收购相关费用、重组费用和转回以及或有对价公允价值变动进行调整)有助于投资者评估我们的核心经营业绩和财务表现,因为它排除了简明合并运营报表中反映的重大非现金或非经常性项目。 我们认为,将调整后 EBITDA 按收入百分比列报非常有用,因为它提供了一种可靠、一致的方法来衡量我们每年的业绩,并将我们的业绩与其他公司的业绩进行对比评估。 我们相信这一信息有助于比较经营业绩和公司业绩,其中不包括我们的资本结构和资产收购方法的影响。

投资者联系方式:

罗布-贝内特

投资者关系

迪吉国际

952-912-3524

电子邮件:rob.bennett@digi.com