Revenue of $106M, Record End of Quarter ARR of $108M

ARR Surpasses Quarterly Revenue for First Time

Cash Flow From Operations was $19 Million

(Minneapolis, MN, January 31, 2024) - Digi International ® Inc. (Nasdaq: DGII), a leading global provider of business and mission critical Internet of Things ("IoT") products, services and solutions, today announced its financial results for its first fiscal quarter ended December 31, 2023.

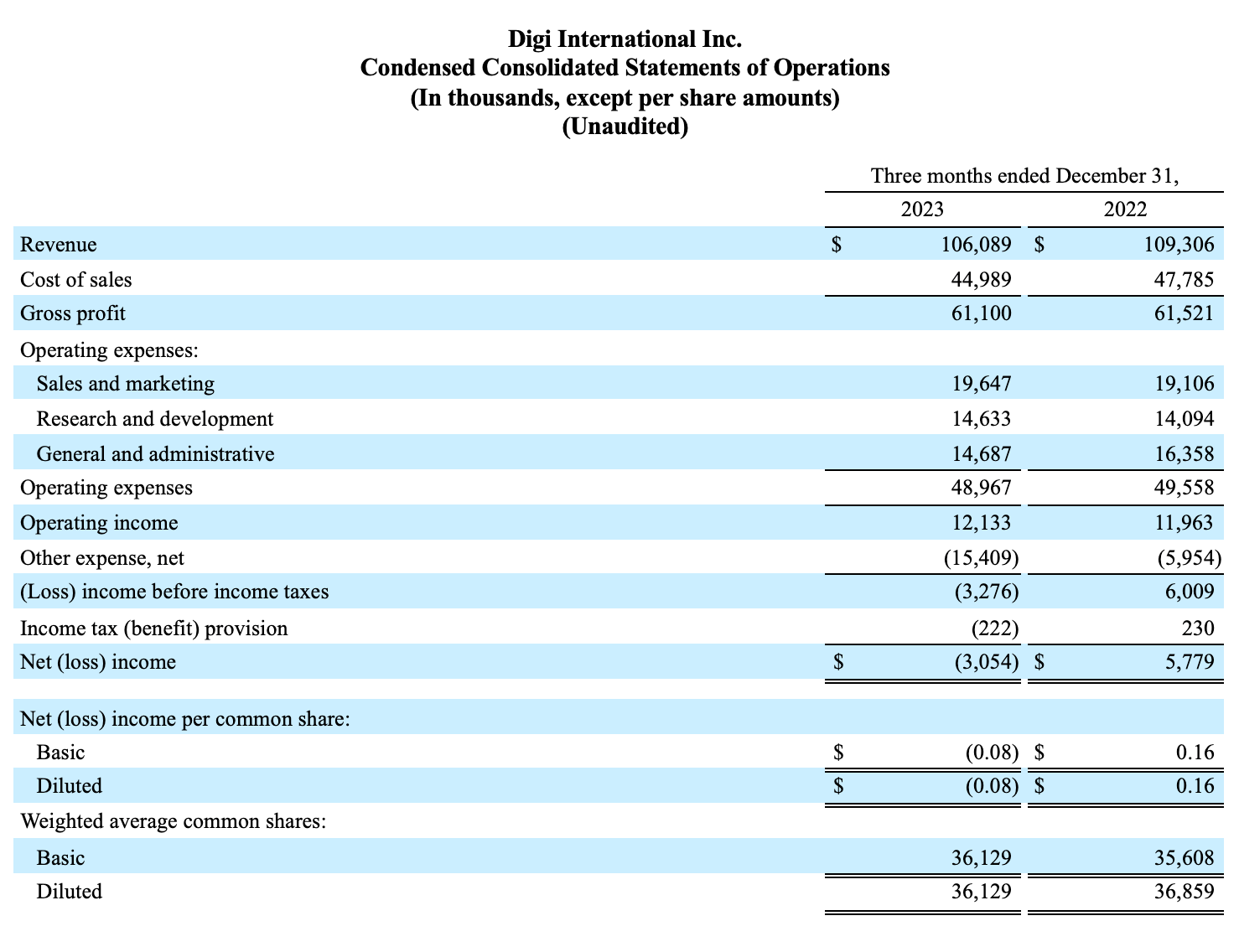

First Fiscal Quarter 2024 Results Compared to First Fiscal Quarter 2023 Results

- Revenue was $106 million, a decrease of 3%.

- Gross profit margin was 57.6%, an increase of 130 basis points.

- Net loss per diluted share was $0.08, driven by the $0.26 impact of the term B debt issuance cost write off, compared to net income per diluted share of $0.16.

- Adjusted net income per diluted share was $0.48, flat year over year.

- Adjusted EBITDA was $23 million, flat year over year.

- Annualized Recurring Revenue (ARR) was $108 million at quarter end, an increase of 13%.

本新闻稿末尾载有 GAAP 和非 GAAP 财务指标的调节表。

"Double digit ARR growth propelled Digi to reach a milestone of ARR exceeding quarterly revenue for the first time," said Ron Konezny, President and Chief Executive Officer. "Lowered inventory levels combined with a reduction in debt significantly improved our balance sheet. We are committed to achieving $200 million of ARR and $200 million of adjusted EBITDA within the next five years."

其他财务要点

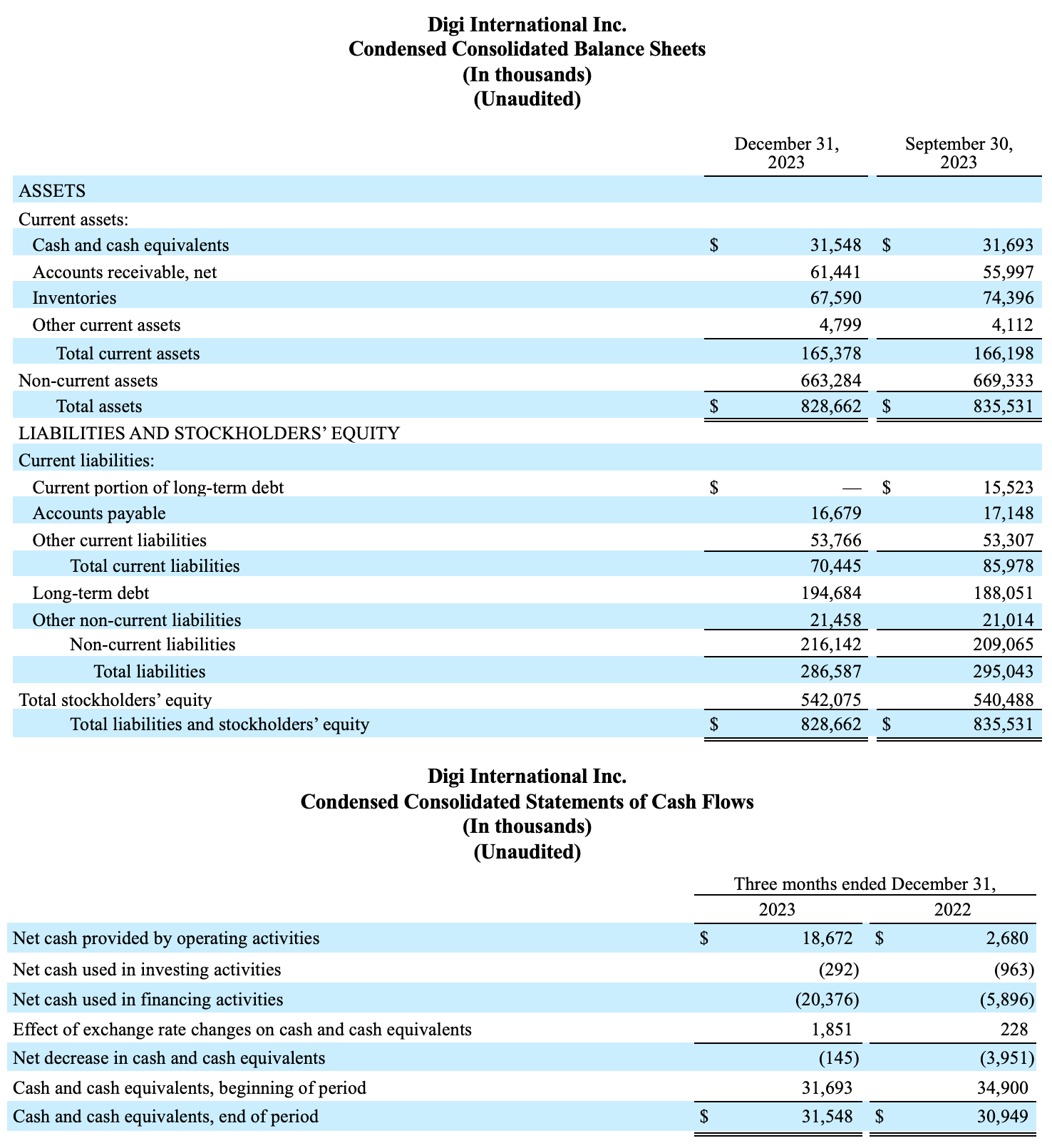

- We retired the term loan existing under our prior credit facility in the first quarter of fiscal 2024, incurring a one-time expense of $10 million for the write-off of debt issuance costs. In addition, we made payments towards our new revolving credit facility, reducing our gross outstanding debt to $196 million at quarter end and debt net of cash and cash equivalents to $163 million.

- We had $5.7 million of interest expense in the first quarter of fiscal 2024, compared to $6.0 million a year ago. The decrease was driven by reduction of our effective interest rate and decreased debt outstanding.

- Cash flow from operations was $19 million in the first quarter of fiscal 2024, compared to $3 million a year ago, driven primarily by year over year changes in inventory.

- Net inventory ended the quarter at $68 million, compared to $74 million at September 30, 2023. This represents a $13 million reduction from the balance a year ago, reflecting continued efforts to manage inventory levels.

分部业绩

IoT 产品与服务

The segment's first fiscal quarter 2024 revenue of $82 million decreased 3% from the same period in the prior fiscal year. This decrease was driven by decreases in sales volume in Console Server and Cellular products, partially offset by growth in OEM products. ARR as of the end of the first fiscal quarter was $23 million, an increase of 64% from the prior fiscal year. This increase primarily was due to growth in the subscription base for Console Server services, complemented by growth in other business lines. Gross profit margin decreased 110 basis points to 53.5% of revenue for the first fiscal quarter of 2024, driven primarily by decreased volume in Console Server, partially offset by increased volume and higher margin mix in OEM. Operating income was $10 million, a decrease of 18%, primarily due to the decrease in revenue.

IoT 解决方案

The segment's first fiscal quarter 2024 revenue of $24 million decreased 4% from the same period in the prior fiscal year. This decrease was a result of decreased sales of Ventus offerings, partially offset by volume growth in SmartSense. ARR as of the end of the first fiscal quarter was $85 million, an increase of 4% from the prior fiscal year primarily driven by growth in SmartSense. Increased revenue and expanding margins in SmartSense drove a 950 basis points gross margin increase to 71.6% in the first fiscal quarter of 2024. Operating income was $1.8 million, compared to an operating loss of $0.7 million a year ago.

资本分配战略

We intend to continue to deleverage the company while managing inventory appropriately as our supply chain continues to normalize. Our inventory position remains elevated, but we believe this investment will deliver working capital benefits for Digi in future quarters.

Acquisitions remain a top capital priority for Digi. We will be disciplined in our approach and act when we believe an opportunity is appropriate to execute in the context of prevailing market conditions. We are evolving and monitoring our acquisition pipeline, and we intend to focus more on scale and ARR.

Second Fiscal Quarter 2024 and Full-Year 2024 Guidance

Digi remains steadfast in achieving our new long term strategic goals of doubling ARR and Adjusted EBITDA to $200 million within the next five years. Digi’s resilient execution in a large and growing Industrial Internet of Things market has stayed consistent. Our outlook for fiscal 2024 remains unchanged, with our ARR and Adjusted EBITDA growing 5% and our revenue projects to be flat year over year.

For the second fiscal quarter, revenues are estimated to be $105 million to $109 million. Adjusted EBITDA is estimated to be between $22.5 million and $24.5 million. Adjusted net income per share is anticipated to be between $0.45 and $0.49 per diluted share, assuming a weighted average diluted share count of 37.7 million shares.

We provide guidance or longer-term targets for Adjusted net income per share as well as Adjusted EBITDA targets on a non-GAAP basis. We do not reconcile these items to their most similar U.S. GAAP measure as it is difficult to predict without unreasonable efforts numerous items that include but are not limited to the impact of foreign exchange translation, restructuring, interest and certain tax related events. Given the uncertainty, any of these items could have a significant impact on U.S. GAAP results.

First Fiscal Quarter 2024 Conference Call Details

As announced on January 19, 2024, Digi will discuss its first fiscal quarter results on a conference call on Thursday, February 1, 2024 at 10:00 a.m. ET (9:00 a.m. CT). The call will be hosted by Ron Konezny, President and Chief Executive Officer and Jamie Loch, Chief Financial Officer.

Participants may register for the conference call at: https://register.vevent.com/register/BI5fa5a3d6e5ca4856948123f5f6ddf85e. Once registration is completed, participants will be provided a dial-in number and passcode to access the call. All participants are asked to dial-in 15 minutes prior to the start time.

Participants may access a live webcast of the conference call through the investor relations section of Digi’s website, https://digi.gcs-web.com/ or the hosting website at: https://edge.media-server.com/mmc/p/tn9spd4c/.

重播将在电话会议结束后约两小时内提供,为期约一年。您可以通过 Digi 网站的 "投资者关系 "版块访问网络广播重播。

您可以通过 Digi 网站www.digi.com 的 "投资者关系 "部分的 "财务新闻稿 "页面查阅本财报。

有关我们的更多新闻和信息,请访问www.digi.com/aboutus/investorrelations。

关于 Digi International

Digi International(纳斯达克股票代码:DGII)是全球领先的IoT 连接产品、服务和解决方案提供商。我们帮助客户创造下一代连接产品,在高要求环境中部署和管理关键通信基础设施,并提供高水平的安全性和可靠性。公司成立于 1985 年,目前已帮助客户连接了 1 亿多个设备,并且还在不断增长。欲了解更多信息,请访问 Digi 网站 www.digi.com。

前瞻性陈述

This press release contains forward-looking statements that are based on management’s current expectations and assumptions. These statements often can be identified by the use of forward-looking terminology such as "anticipate," "assume," "believe," "continue," "estimate," "expect," "intend," "may," "plan," "potential," "project," "should," "target," or "will" or the negative thereof or other variations thereon or similar terminology. Among other items, these statements relate to expectations of the business environment in which Digi operates, projections of future performance, inventory levels, perceived marketplace opportunities, interest expense and statements regarding our mission and vision. Such statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions. Among others, these include risks related to ongoing and varying inflationary and deflationary pressures around the world and the monetary policies of governments globally as well as present concerns about a potential recession, the ability of companies like us to operate a global business in such conditions as well as negative effects on product demand and the financial solvency of customers and suppliers in such conditions, risks related to ongoing supply chain challenges that continue to impact businesses globally, risks related to cybersecurity, risks arising from the present wars in Ukraine and the Middle East, the highly competitive market in which our company operates, rapid changes in technologies that may displace products sold by us, declining prices of networking products, our reliance on distributors and other third parties to sell our products, the potential for significant purchase orders to be canceled or changed, delays in product development efforts, uncertainty in user acceptance of our products, the ability to integrate our products and services with those of other parties in a commercially accepted manner, potential liabilities that can arise if any of our products have design or manufacturing defects, our ability to integrate and realize the expected benefits of acquisitions, our ability to defend or settle satisfactorily any litigation, the impact of natural disasters and other events beyond our control that could negatively impact our supply chain and customers, potential unintended consequences associated with restructuring, reorganizations or other similar business initiatives that may impact our ability to retain important employees or otherwise impact our operations in unintended and adverse ways, and changes in our level of revenue or profitability which can fluctuate for many reasons beyond our control. These and other risks, uncertainties and assumptions identified from time to time in our filings with the United States Securities and Exchange Commission, including without limitation, those set forth in Item 1A, Risk Factors, of our Annual Report on Form 10-K for the year ended September 30, 2023, subsequent filings on Form 10-Q and other filings, could cause our actual results to differ materially from those expressed in any forward-looking statements made by us or on our behalf. Many of such factors are beyond our ability to control or predict. These forward-looking statements speak only as of the date for which they are made. We disclaim any intent or obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

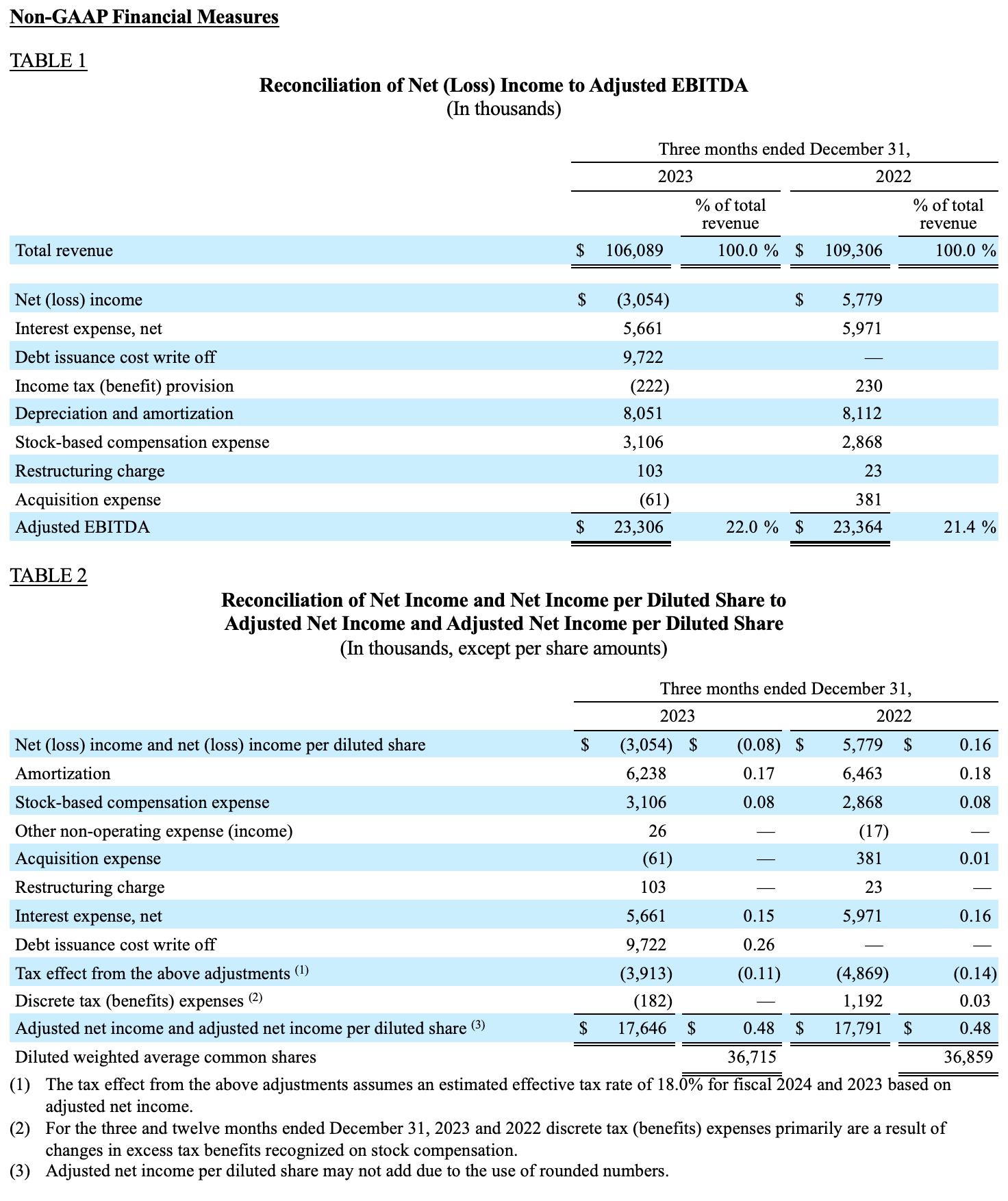

非美国通用会计准则财务指标的列报

本新闻稿包括调整后净收入、调整后摊薄后每股净收入和调整后息税折旧摊销前利润(EBITDA),其中每项均为非美国通用会计准则(Non-GAAP)指标。

我们知道,非美国通用会计准则的使用存在重大限制。在分析财务业绩时,非美国通用会计准则(Non-GAAP)指标不能替代净收入等美国通用会计准则(GAAP)指标。这些指标的披露并不反映 Digi 实际确认的所有费用和收益。这些非美国通用会计准则(Non-GAAP)衡量标准不符合公认会计原则,也不能替代按照公认会计原则编制的衡量标准,可能与其他公司使用的非美国通用会计准则(Non-GAAP)衡量标准或我们在以前的报告中提出的衡量标准不同。此外,这些非美国通用会计准则衡量标准并非基于任何一套全面的会计规则或原则。我们认为,非美国通用会计准则衡量标准有其局限性,因为它们不能反映按照美国通用会计准则确定的与我们的运营结果相关的所有金额。我们认为,这些指标只能与相应的公认会计准则指标一起用于评估我们的运营结果。此外,调整后 EBITDA 并不反映我们的现金支出、更换折旧资产和摊销资产的现金需求,也不反映我们营运资金需求的变化或现金需求。

我们认为,分别提供历史净利润和调整后净利润以及调整后摊薄后每股净利润,不包括税收准备金转回、离散税收优惠、重组费用及转回、无形资产摊销、股票薪酬、其他营业外收入/支出、或有对价公允价值变动、与收购相关的费用以及与收购相关的利息支出等项目,可以让投资者将业绩与不包括这些项目的前期进行比较。管理层使用上述非美国通用会计准则衡量标准来监控和评估持续经营业绩和趋势,并了解我们的比较经营业绩。此外,我们的某些股东表示希望看到不包含这些事项影响的财务业绩指标,这些事项虽然重要,但对我们的核心业务运营并不重要。管理层认为,调整后息税折旧摊销前利润(定义为息税折旧摊销前利润,根据股票薪酬费用、收购相关费用、重组费用和转回以及或有对价公允价值变动进行调整)有助于投资者评估我们的核心经营业绩和财务表现,因为它排除了简明合并运营报表中反映的重大非现金或非经常性项目。我们认为,将调整后 EBITDA 按收入百分比列报非常有用,因为它提供了一种可靠、一致的方法来衡量我们每年的业绩,并将我们的业绩与其他公司的业绩进行对比评估。我们相信这一信息有助于比较经营业绩和公司业绩,其中不包括我们的资本结构和资产收购方法的影响。

投资者联系方式:

罗布-贝内特

投资者关系

迪吉国际

952-912-3524

电子邮件: rob.bennett@digi.com